who pays sales tax when selling a car privately in texas

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard. Reporting the Sale for Tax Purposes Once you have sold your vehicle you need to report the sale to the Department of Transportation.

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or.

. The seller will collect the tax if the seller is a dealer licensed by Texas Department of Motor Vehicles TxDMV and the motor vehicles gross weight is 11000. How much is a title transfer in Texas. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard.

The sales tax for cars in Texas is 625 of the final sales price. Once the buyer has the vehicle registered under his name he must pay to sell Texas. Answer 1 of 9.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or. When reporting the sale you should.

According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. To calculate how much sales tax youll owe simply. That depends on the sate and the laws regarding sales tax.

This important information is crucial when youre selling your car because you dont. For retail sales of new and used motor vehicles involving licensed motor vehicle dealers the motor vehicle. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

For example theres a state sales tax on the. However your daughter will have to pay whatever rate of sales tax your state charges on used vehicles when she goes to transfer the title. If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another method in order.

In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing. Tax is not due until that time.

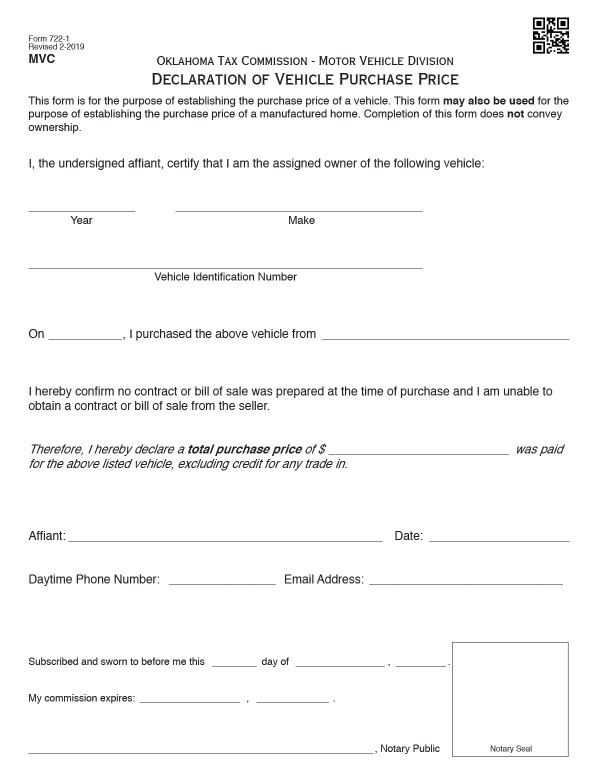

Bills Of Sale In Oklahoma The Templates Facts You Need

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

How To Avoid Paying Car Sales Tax The Legal Way Youtube

What Paperwork Do I Need To Sell My Car Privately Privateauto

Virginia Sales Tax On Cars Everything You Need To Know

Understanding Taxes When Buying And Selling A Car Cargurus

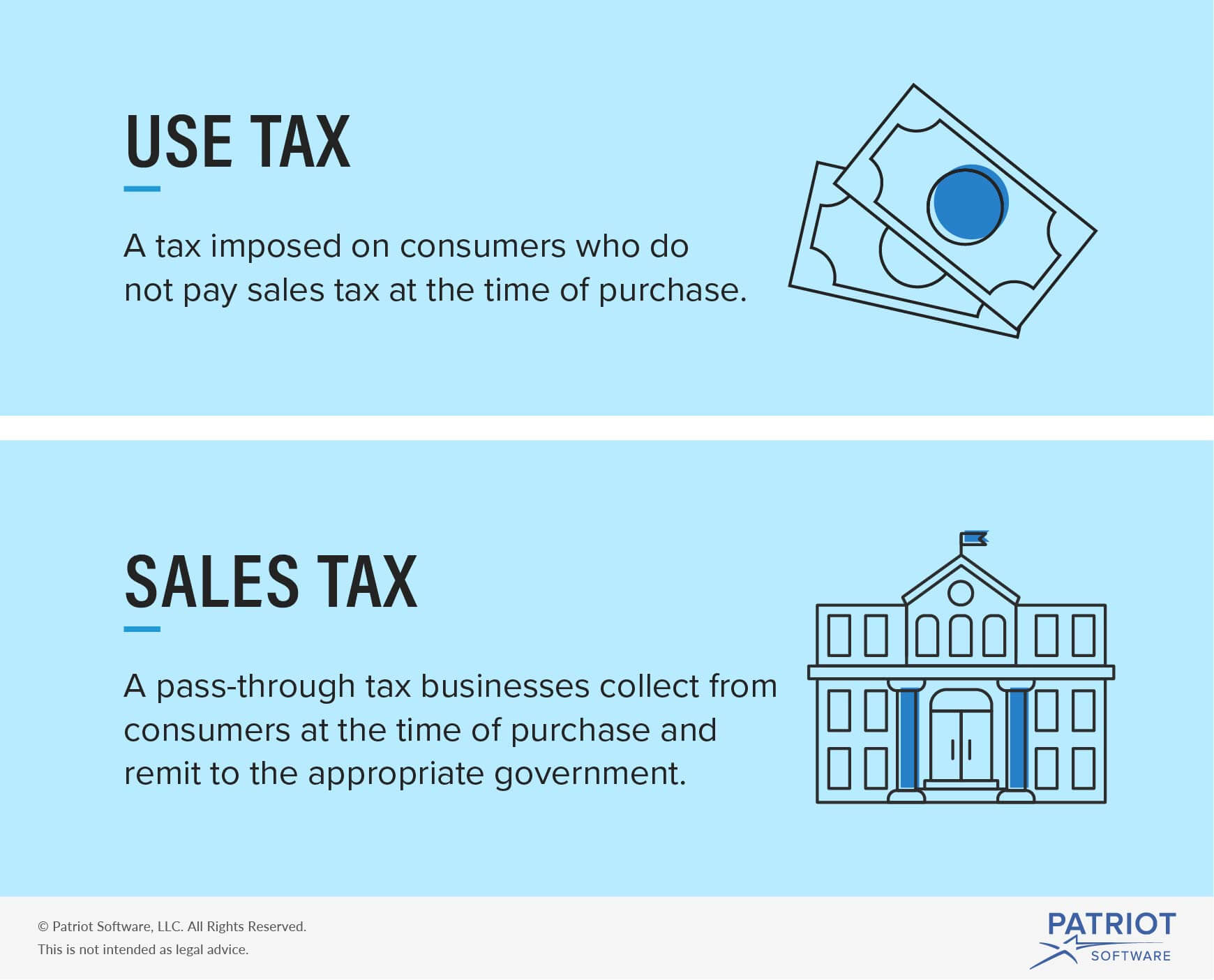

Use Tax What Is It And What Are Your Business Owner Responsibilities

3 Ways To Still Avoid Sales Tax Online

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

How Do State And Local Sales Taxes Work Tax Policy Center

Free Bill Of Sale Forms 24 Word Pdf Eforms

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

How To Transfer A Car Title In South Carolina Yourmechanic Advice

Colorado Sales Tax Rate Rates Calculator Avalara

When I Sell My Car Do I Have To Pay Taxes Carvio

Do You Pay Sales Tax On A Lease Buyout Bankrate

Can Buy A Car Below Market Value And Resell It For A Profit Without Registering And Paying Taxes On It In California Quora

:max_bytes(150000):strip_icc():gifv()/BillofSale-d0a63400e8c942cab9b481536629f278.jpeg)